Hey there, MyBusinessBro readers! The world of stablecoins has been seeing a breakout year for tether (USDT), setting new records and making some deep pockets. If all goes well, Tether’s performance in 2024 is about to reveal what should happen to digital finance as we know it.

So, What Exactly is USDT? 🧐

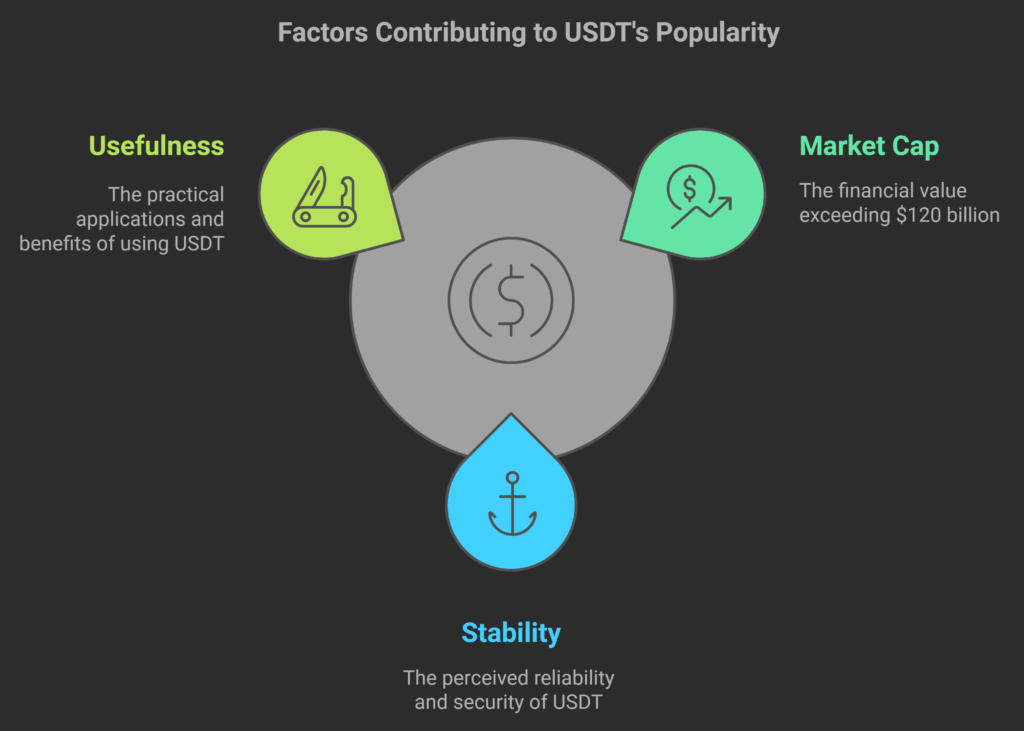

If you’re new to Tether, it’s what’s known as a stablecoin—basically, a cryptocurrency that stays steady because it’s linked 1:1 to the U.S. dollar. It is to keep the unstable crypto world stable. Here’s why it’s popular:

1. Fast Transfers:

– In no time, you can send and receive money globally.

2. Safe Haven :

– For people living in volatile markets, USDT becomes a secure digital dollar.

3. Top Trading Option:

– Such freedom of swaps is also driven by Tether – it is a top choice for trading pairs and you can swap tokens between crypto and a USD like coin in just a click.

📊 Key Highlights for 2024

This year, tether has hit some pretty big milestones. Check out the highlights:

1. Major Revenue Gains:

Revenue from Tether was a whopping $7.7 billion in the first three quarters of 2024. Clearly, there is still a huge demand for stablecoins in an uncertain economy.

2. New All-Time High Market Cap:

As of late October 2024, Tether’s (USDT) market cap has surpassed $120 billion Because of this, it’s the most popular and most commonly used stablecoin in the world, utilised by people’s trust in its stability and usefulness. (Source: coingecko)

3. How Tether Earns Its Money:

🔹 Interest on U.S. Treasuries:

Investments in U.S. Treasury securities are Tether’s biggest revenue source. Looking at the high interest rates today, these bonds are paying a steady, predictable return.

🔹 Transaction Fees:

USDT is also used, to a great extent, for trading on crypto exchange platforms and this earns tether money from transaction fees. Tether sees a piece of each trade where a USDT is traded.

🔹 Lending and Investments:

Additionally, Tether diversified its revenues from other low risk lending and investments, which ensured that the revenue remained stable and users felt safer.

4. Growing Demand:

USDT is especially appreciated by people in developing markets with unstable currencies. Tether’s growth has been steady thanks to millions of users worldwide relying on it for savings, payments and trading.

5. Influence on the Crypto Market:

Tether is providing stability for the crypto market. But when the going gets tough USDT functions as safe port to the liquidity necessary to continue the flow.

Paolo Ardoino’s Vision for Tether: Transforming Digital Finance for All—👤

Tether’s CEO, Paolo Ardoino believes that the future is all about making finance available to everyone everywhere. Paolo Ardoino mentioned that Tether is a helpful tool for financial inclusion in places with few banking options, especially in the areas where he works. With USDT, he envisions the digital currency will be more than just a stable currency—it will be a bridge to the power of financial access for people all around the world who have been denied access by the likes of traditional banking.

📌 Why It Matters to You

Record market cap and booming earnings of stablecoins are signs that the world is starting to take stablecoins seriously. With the continued growth of Tether, they are helping grow crypto in a mature way and provide a real solution in the traditional finance space. Whether you’re a rookie in crypto or an old pro, Tether’s success is a reminder that digital finance is durable and still has a future in a reeling economic landscape