Hey there, innovators! 💡

Welcome back to MyBusiness Bro! Today, we’re diving into the world of Bitcoin ETFs—a game-changing way to invest in Bitcoin without actually owning it. Whether you’re new to crypto or an experienced investor, this guide is for you! Grab your coffee, and let’s break it down. ☕🔍

Today’s Highlights 🍜:

What Are Bitcoin ETFs?

They’re like buying stocks but track Bitcoin’s price.

Why Choose Crypto ETFs?

Easy trading, lower risk, and no tech headaches.

The Future is Bright:

Experts predict Bitcoin ETFs could hit a $50 billion market cap by 2025.

Today’s Scoop: Crypto ETFs Made Simple 🧩

It doesn’t have to be complex to invest in Bitcoin. Investing in Bitcoin through bitcoin ETFs removes the tech headaches and risks while performing the same it does when you buy stocks. Ready to dive in? Let’s break it down!

What is a Crypto ETFs? 🤔

An ETF (Exchange Traded Funds) is at its core a type of investment fund bought or sold in the Exchange just as stocks are. A Bitcoin ETF is just a tracking of the price of Bitcoin so that an investor can invest in Bitcoin without actually possessing Bitcoin itself. 🌐💸

Bitcoin ETFs: Who Can Invest in Them? 🧑💼

if you hold a brokerage account, one can easily trade in Bitcoin ETFs. Buying stocks is that simple. For the new to crypto, a great way to get in, and for the experienced, a different route to Bitcoin could be taken. 📈💡

Why Crypto ETFs? What’s the Big Deal?

No Require for Bitcoin Wallets: Bitcoin ETF evacuates the require to bargain with complex advanced wallets.

Diversification: With another asset in your portfolio, you can invest in Bitcoin.

Regulated Investment: One security that your investors have is that they are regulated with Bitcoin ETFs. ✅

Easier to Trade: It’s just as easy as buying stocks to buy and sell Bitcoin ETFs. 📊

Bitcoin ETH Total AUM & Top Issuers 📊

The Assets Under Management (AUM) in Bitcoin ETFs are growing rapidly as of now. Here’s a see at the current numbers:

Grayscale Bitcoin Trust (GBTC): $20+ billion

ProShares Bitcoin Strategy ETF (BITO): $10+ billion

Some of the leading ETF issuers include:

- ProShares

- Valkyrie Investments

- Grayscale

- Purpose Investments

Leading the way in the Bitcoin ETF industry are these companies, bringing crypto investing within reach 🤝

Why I Buy a Bitcoin ETF 🤩🤷♂️💡

Why not simply buy Bitcoin yourself?” Here’s why:

- 1. Lower Risk: This is because Bitcoin ETFs empower you to invest into Bitcoin without all the volatility of holding Bitcoin directly.

- 2. Convenience: You’ll never have to manage a digital wallet and never fear losing the private keys.

- 3. Familiar Investment Structure: Again, ETFs are a familiar investment vehicle, and therefore easier for traditional investors to navigate.

Bitcoin ETFs: How to Invest? 📈

Here’s how to get started:

1. Open a Brokerage Account: Go with a brokerage, like Fidelity or Charles Schwab to sign up.

2. Search for Bitcoin ETFs: To find bitcoin ETFs use ticker symbols like BITO or GBTC.

3. Make Your Purchase: When you have chosen to invest an ETF you wish to invest in, you place your desired order like you would for any other stock.

Popular Bitcoin ETFs 📋

Here’s a list of some of the most popular Bitcoin ETFs and their details:

1. This is ProShares Bitcoin Procedure ETF (BITO)

- Launch Date: October 2021

- AUM: $10+ billion

- Fee: 0.95%

- Average Daily Volume: 3.5 million shares

2. GBTC

- Launch Date: 2013

- AUM: $20+ billion

- Fee: 2.0%

- Average Daily Volume: 1 million shares

3. It comprises of Valkyrie Bitcoin Procedure ETF (BTF)

- Launch Date: October 2021

- AUM: $1 billion

- Fee: 0.95%

- Average Daily Volume: 200,000 shares

- Which is the most Bitcoin holding ETF? 🏆

At the moment, Grayscale Bitcoin Trust (GBTC) has around 600,000 Bitcoin, or over 3% of all Bitcoin in circulation. That’s a lot of Bitcoin! 🍰

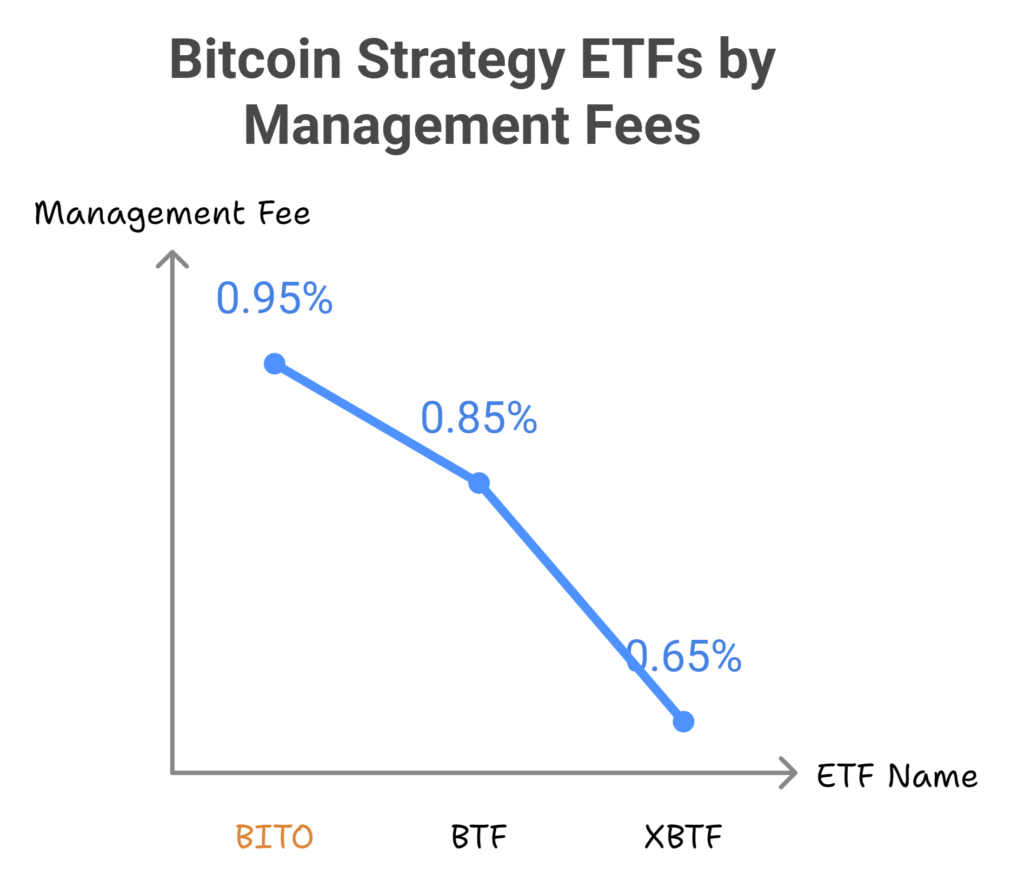

Top Fee 💸 Bitcoin Strategy ETFs

Here are the Bitcoin ETFs that charge the most reduced fees:

- 1. BITO – ProShares Bitcoin Methodology ETF – 0.95%

- 2. Valkyrie Bitcoin Procedure ETF (BTF) – 0.85%

- 3. XBTF: 0.65%

You can save more of your money so it is invested in the fund instead of paying for management fees. 💵

The Best Bitcoin ETF Right Now? 🔥

Currently, one of the best Bitcoin ETFs on the market today is ProShares Bitcoin Strategy ETF (BITO). The best bit about it is that it provides a perfect balance of very low fees and strong liquidity, which makes it a favorite choice for many investors. 📈

Bitcoin ETF’s Future Growth 📆

The future of Bitcoin ETF is looking bright. We can see Bitcoin ETFs becoming more popular as institutional investors, hedge funds and even retirement funds start accepting Bitcoin. By 2025, experts believe that the Bitcoin ETFs total market cap could be around $50b 🚀

Bottom Line 🧐

The Crypto ETFs are a regulation and more simple option to invest with Bitcoin without risking managing the digital currency. But with adoption growing within institutions, these ETFs are only destined to be more popular in years to come. Are you new to the cryptocurrency scene or trying to grow your crypto portfolio?

Looking to see what else I’ll be cringey inspo tweeting about in the next issue of this? Stay tuned! 🤑